As technology continues to evolve and become an integral part of our daily lives, ethical considerations in app development have become increasingly important. From safeguarding user privacy to ensuring equitable access and preventing misuse, developers must navigate a complex landscape of ethical challenges. This detailed guide explores the ethical considerations in app development, providing insights into best practices and strategies to address these challenges.

1. Understanding Ethics in App Development

1.1 What is Ethical App Development?

Ethical app development refers to the practice of creating software in a manner that upholds moral principles, including respect for user privacy, fairness, transparency, and social responsibility. It involves making decisions that prioritize the well-being of users and society while minimizing potential harm.

1.2 Importance of Ethical Considerations

- User Trust: Ethical practices build trust with users, fostering loyalty and positive engagement.

- Regulatory Compliance: Adhering to ethical standards helps ensure compliance with legal and regulatory requirements.

- Social Responsibility: Developers have a responsibility to consider the broader impact of their apps on society and the environment.

2. Key Ethical Considerations in App Development

2.1 User Privacy and Data Protection

Overview: Protecting user privacy and ensuring data security are fundamental ethical concerns in app development. Developers must handle user data responsibly, comply with regulations, and be transparent about data practices.

Key Issues:

- Data Collection: Limit data collection to what is necessary for the app’s functionality. Avoid collecting sensitive data unless absolutely required.

- Data Usage: Use data only for the purposes stated in the app’s privacy policy. Avoid sharing or selling user data without explicit consent.

- Data Security: Implement robust security measures to protect user data from breaches and unauthorized access.

- User Consent: Obtain informed consent from users before collecting or processing their data. Provide clear options to opt-in or opt-out.

Best Practices:

- Transparency: Clearly communicate how user data will be used and protected.

- Data Minimization: Collect only the data necessary for the app’s functionality.

- Encryption: Use encryption to safeguard data during transmission and storage.

- Compliance: Adhere to data protection regulations such as GDPR, CCPA, and others.

Example: An app that tracks users’ location should provide clear information about why location data is needed, how it will be used, and obtain user consent before collecting it.

2.2 Informed Consent and User Autonomy

Overview: Informed consent involves providing users with all necessary information to make decisions about using an app and understanding its impact. User autonomy refers to respecting users’ choices and preferences.

Key Issues:

- Clarity: Ensure that consent forms and privacy policies are written in plain language and are easily understandable.

- Voluntariness: Users should have the freedom to consent or decline without facing negative consequences.

- Reversibility: Provide users with the option to withdraw consent and delete their data at any time.

Best Practices:

- User Education: Educate users about the app’s features and data practices through clear and concise documentation.

- Consent Mechanisms: Implement user-friendly mechanisms for obtaining and managing consent.

- Easy Opt-Out: Allow users to easily opt-out of data collection and other features.

Example: A fitness app should explain how it will use health data and give users the ability to customize their privacy settings and revoke access if desired.

2.3 Accessibility and Inclusivity

Overview: Accessibility and inclusivity ensure that apps are usable by people with diverse abilities and backgrounds. Ethical app development involves designing apps that are accessible to everyone, including those with disabilities.

Key Issues:

- Accessibility Features: Incorporate features such as screen readers, voice commands, and adjustable font sizes.

- Inclusive Design: Design interfaces that consider diverse user needs, including color blindness, motor impairments, and cognitive disabilities.

- Cultural Sensitivity: Ensure that the app’s content and design are culturally sensitive and inclusive.

Best Practices:

- Compliance: Follow accessibility guidelines and standards, such as the Web Content Accessibility Guidelines (WCAG).

- User Testing: Conduct usability testing with diverse user groups to identify and address accessibility issues.

- Feedback Mechanisms: Provide channels for users to give feedback on accessibility and inclusivity features.

Example: A news app should provide text-to-speech functionality for visually impaired users and ensure that its design is compatible with screen readers.

2.4 Data Ownership and Control

Overview: Data ownership refers to the rights users have over their personal data. Ethical app development involves respecting users’ control over their data and providing them with ownership rights.

Key Issues:

- Data Portability: Allow users to easily export their data in a usable format.

- Data Deletion: Provide users with the ability to delete their data and accounts upon request.

- Transparency: Inform users about their rights regarding data ownership and control.

Best Practices:

- Data Access: Implement features that allow users to access and manage their data.

- Data Deletion Requests: Process data deletion requests promptly and ensure that user data is fully removed.

- Privacy Policy: Clearly outline data ownership and control rights in the privacy policy.

Example: An app that stores user-generated content should allow users to download their content and delete their accounts if they choose to leave.

2.5 Ethical Monetization and Advertising

Overview: Ethical monetization involves generating revenue without compromising user trust or experience. Ethical advertising practices ensure that ads are transparent, non-intrusive, and respect user privacy.

Key Issues:

- Ad Transparency: Clearly label ads and differentiate them from content.

- Data Usage: Avoid using sensitive data for targeted advertising without explicit consent.

- In-App Purchases: Implement fair and transparent in-app purchase practices, avoiding deceptive or manipulative tactics.

Best Practices:

- Ad Disclosure: Clearly disclose when content is sponsored or includes advertising.

- User Choice: Provide users with options to control ad preferences and limit tracking.

- Fair Pricing: Ensure that in-app purchases and subscriptions are transparent and offer clear value.

Example: A gaming app should clearly distinguish between in-game purchases and gameplay content, and provide users with options to control ad preferences.

3. Legal and Regulatory Considerations

3.1 Privacy Laws and Regulations

Overview: Privacy laws and regulations govern how user data should be collected, stored, and processed. Developers must ensure compliance with applicable laws to avoid legal issues and maintain user trust.

Key Regulations:

- General Data Protection Regulation (GDPR): Regulates data protection and privacy in the European Union.

- California Consumer Privacy Act (CCPA): Provides privacy rights to California residents.

- Children’s Online Privacy Protection Act (COPPA): Protects the privacy of children under 13 in the United States.

Best Practices:

- Compliance: Stay informed about relevant privacy laws and ensure that your app complies with them.

- Legal Consultation: Consult with legal experts to ensure that privacy policies and practices are up-to-date and legally sound.

Example: An app operating in the EU must comply with GDPR by providing users with the ability to access, correct, and delete their personal data.

3.2 Intellectual Property and Copyright

Overview: Respecting intellectual property rights involves ensuring that your app does not infringe on the copyrights or trademarks of others. It also includes protecting your own intellectual property.

Key Issues:

- Licensing: Use third-party libraries and assets according to their licenses and provide proper attribution.

- Originality: Ensure that your app’s design and functionality do not violate existing patents or trademarks.

Best Practices:

- Proper Licensing: Use and attribute third-party resources according to their licensing agreements.

- IP Protection: Protect your app’s intellectual property through trademarks, patents, or copyrights as appropriate.

Example: If your app uses open-source libraries, ensure that you comply with their licenses and provide proper attribution in your app’s documentation.

4. Social Impact and Responsibility

4.1 Addressing Social Issues

Overview: Developers should consider the broader social impact of their apps, including potential effects on mental health, social behavior, and societal norms.

Key Issues:

- Mental Health: Consider the impact of app features on users’ mental health and well-being.

- Addiction: Avoid designing features that promote excessive use or addiction.

- Disinformation: Prevent the spread of misinformation and harmful content through your app.

Best Practices:

- Ethical Design: Design features that promote positive social outcomes and avoid exploitative practices.

- Content Moderation: Implement effective content moderation to prevent harmful or misleading content.

Example: Social media apps should implement measures to combat cyberbullying and misinformation while promoting healthy and respectful interactions.

4.2 Environmental Impact

Overview: Consider the environmental impact of your app’s development and operation, including energy consumption and resource usage.

Key Issues:

- Resource Efficiency: Optimize app performance to reduce resource consumption and energy use.

- Sustainable Practices: Adopt sustainable development practices and consider the environmental footprint of server infrastructure.

Best Practices:

- Efficiency: Optimize app performance to minimize resource usage.

- Sustainable Hosting: Choose hosting providers that use renewable energy and sustainable practices.

Example: An app that uses cloud services should choose providers with strong commitments to sustainability and energy efficiency.

5. Future Directions and Emerging Ethical Issues

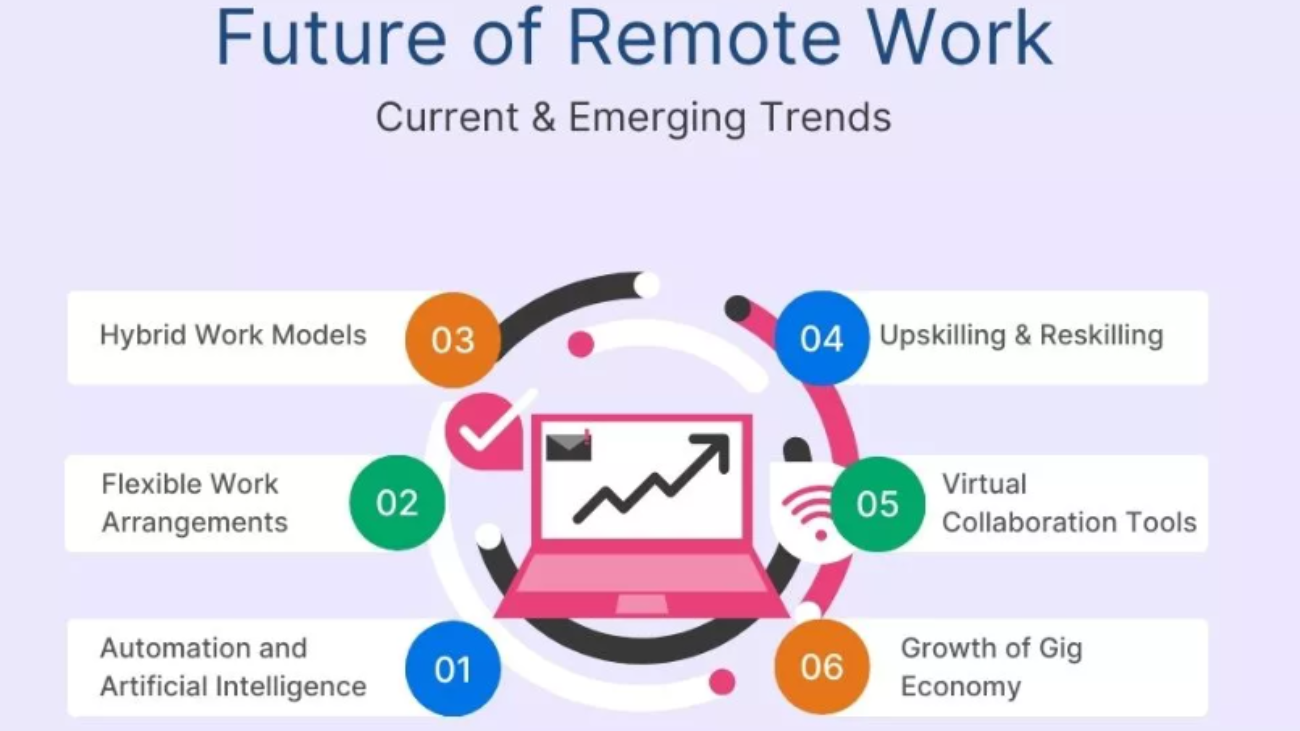

5.1 AI and Machine Learning Ethics

Overview: The integration of AI and machine learning in apps introduces new ethical considerations related to bias, transparency, and accountability.

Key Issues:

- Bias: Ensure that AI algorithms do not perpetuate or amplify biases.

- Transparency: Provide transparency about how AI models make decisions and their potential limitations.

- Accountability: Establish accountability mechanisms for the outcomes generated by AI systems.

Best Practices:

- Bias Mitigation: Implement measures to identify and mitigate bias in AI models.

- Explainability: Provide explanations for AI-driven decisions and ensure user understanding.

- Ethical AI: Follow ethical guidelines and standards for AI development and deployment.

Example: An AI-powered recommendation system should be designed to avoid reinforcing harmful stereotypes or biases.

5.2 Blockchain and Decentralization

Overview: Blockchain technology and decentralized systems introduce new ethical considerations related to privacy, security, and governance.

Key Issues:

- Privacy: Ensure that blockchain applications protect user privacy while maintaining transparency.

- Security: Implement robust security measures to protect decentralized networks from attacks.

- Governance: Establish clear governance structures for decentralized systems.

Best Practices:

- Privacy Protection: Implement privacy-preserving techniques in blockchain applications.

- Security Measures: Use best practices for securing decentralized networks and smart contracts.

- Governance Framework: Develop transparent and fair governance frameworks for decentralized systems.

Example: A decentralized finance (DeFi) app should implement strong security measures and provide users with clear information about how their data is protected.

Conclusion

Ethical considerations in app development are crucial for building trustworthy, responsible, and user-centric applications. By addressing issues related to privacy, informed consent, accessibility, data ownership, and more, developers can create apps that not only meet technical and functional requirements but also uphold moral and ethical standards.

As technology continues to advance, staying informed about emerging ethical challenges and best practices will help developers navigate the evolving landscape of app development. By prioritizing ethics, developers can contribute to a more responsible and positive technological future, fostering trust and creating value for users and society as a whole.